Issuance

On 2 September 2020, the German Federal government issued its first green Federal security – a 10-year green Federal bond maturing in August 2030. Since then, the government has been continuously expanding its sustainable issuance portfolio: every year, additional green Federal securities are issued both through auctions and syndicates.

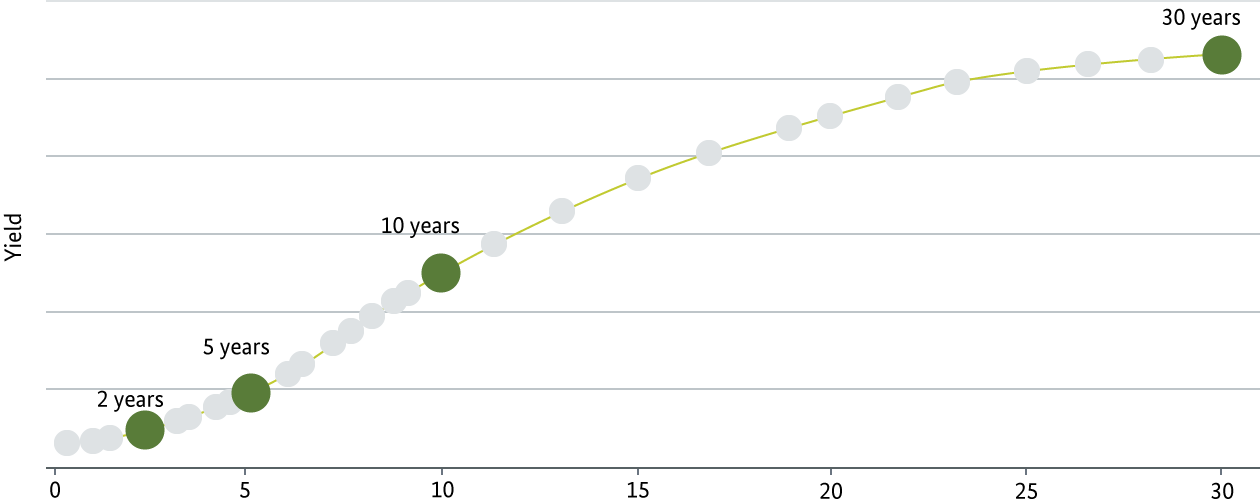

The Green Bund curve now consists of eight different securities with maturities of 5, 10 and 30 years. The Federal Government thus offers investors a wide range of sustainable investment opportunities with different maturities.

In 2025, € 14.5 bn was issued in green Federal securities, which corresponds to 4% of the total issue volume. Eight auction dates were held, including one new issue. This ensures liquidity on the market despite the first maturity of a green Federal security in October 2025.

Following a significant increase in green Federal securities issues until 2024, the issuance volume for 2025 remains at a sustainably high level of € 14.5 bn.

2020: € 11.5 bn

2021: € 12.5 bn

2022: € 14.5 bn

2023: € 17.25 bn

2024: € 17.5 bn

2025: € 14.5 bn

When a new green Federal security is issued, the volume of the conventional twin security is increased by € 1 bn. This additional volume remains in the Federal government's own portfolio and is not placed on the market. Subsequent increases in green Federal securities do not result in a further increase in the own holdings of the conventional twin. This does not affect the Federal Government's flexibility to purchase green Federal securities on the market and sell their conventional twins in return.

Green Federal securities can be issued both through auctions and via syndicates. Issuance is also possible within the framework of multi-ISIN auctions. On 23 January 2024, such an mulit-ISIN-auction took place for the first time with two green Federal securities in parallel – a further step towards strengthening liquidity and market integration.

Recent Issuances

| Date | Issuance | Bid/Cover | Volumes | Yield |

|---|---|---|---|---|

| 21.10.2025 |

Bobl/g (R) DE0001030740 | 4.0 | (A) (B) | 1.86% |

| 21.10.2025 |

Bund/g (R) DE000BU3Z047 | 2.2 | (A) (B) | 2.52% |

| 09.09.2025 |

Bund/g (R) DE0001030732 | 2.3 | (A) (B) | 2.25% |

Bid/Cover ratio: Ratio of volume offered to volume allocated

Issuance History & Progress

Current year vs. previous year

Issuance volume incl. reopenings in own holdings and syndicates carried out (excl. planned). Green Federal securities are only displayed from their announcement in the week prior to their auction.

Green Bund Curve