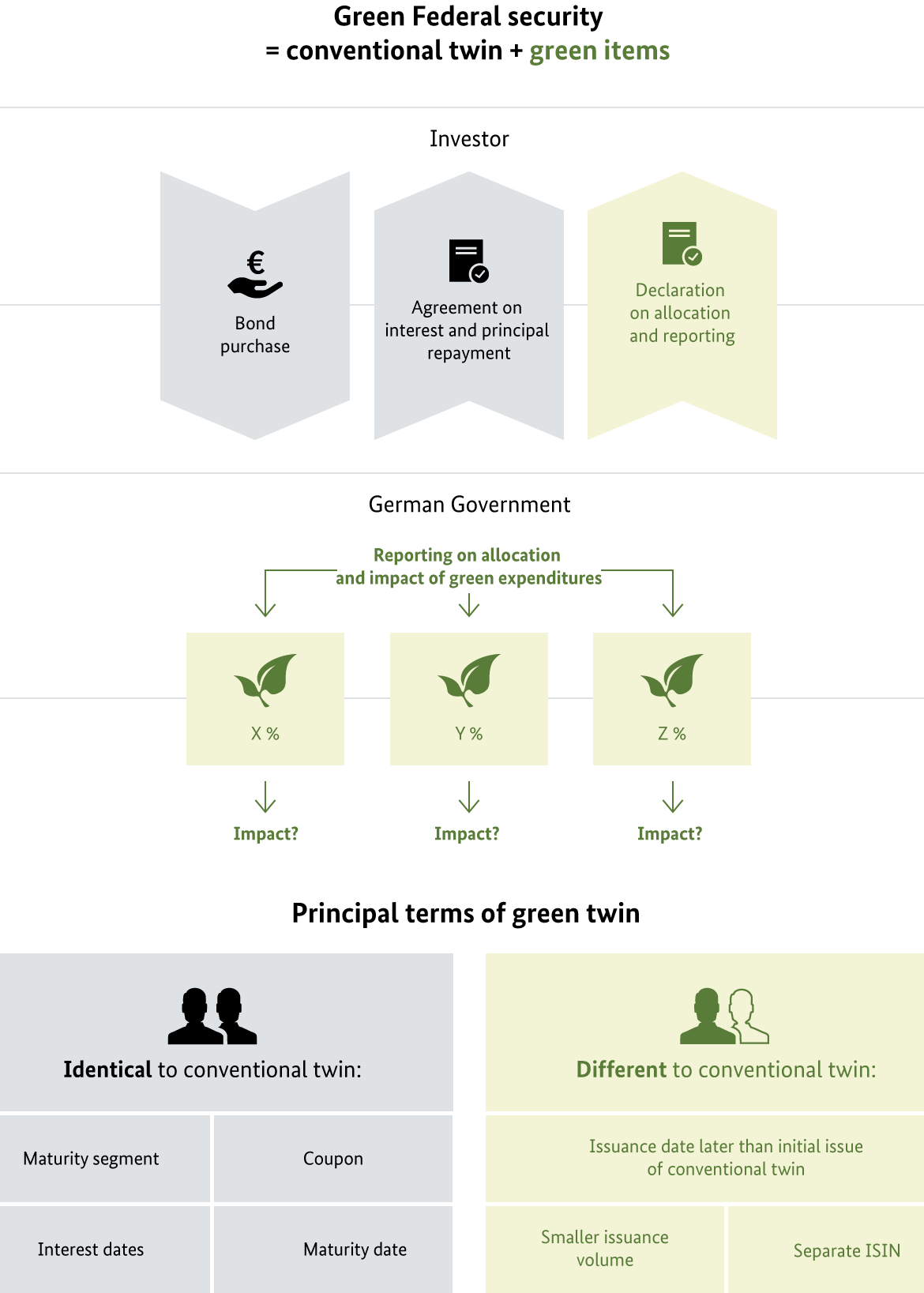

The German Federal government has been issuing green bonds since 2020 and has established a green yield curve for the euro area. The concept of twin bonds makes the value of green investments visible to investors. In this way, the German government is supporting the market for green financial products. Reporting on the green Federal securities also ensures transparency regarding the green expenditures of the Federal budget allocated to them.

Currently Outstanding green Federal Securities

| Bond | Maturity | Coupon | Outstanding | Last Issuance | ISIN |

|---|---|---|---|---|---|

| 2025 (2035) Bund/g | 15.02.2035 | 2.50% | 3,000 € mn | 08.04.2025 | DE000BU3Z047 |

| 2023 (2053) Bund/g | 15.08.2053 | 1.80% | 11,000 € mn | 25.02.2025 | DE0001030757 |

| 2023 (2033) Bund/g | 15.02.2033 | 2.30% | 11,000 € mn | 21.01.2025 | DE000BU3Z005 |

| 2021 (2050) Bund/g | 15.08.2050 | 0.00% | 12,750 € mn | 10.09.2024 | DE0001030724 |

| 2021 (2031) Bund/g | 15.08.2031 | 0.00% | 9,000 € mn | 02.11.2022 | DE0001030732 |

| 2020 (2030) Bund/g | 15.08.2030 | 0.00% | 10,000 € mn | 02.07.2024 | DE0001030708 |

| Bobl/g | 10.10.2025 | 0.00% | 8,500 € mn | 26.03.2024 | DE0001030716 |

| Bobl/g | 15.10.2027 | 1.30% | 9,000 € mn | 23.01.2024 | DE0001030740 |

| Bobl/g | 12.04.2029 | 2.10% | 5,500 € mn | 21.01.2025 | DE000BU35025 |

Awards

Global Capital Bond Awards 2023: "Most Impressive Government ESG Bond Issuer"

Climate Bonds Initiative: "Largest Green Sovereign Bond 2022"

awarded for the 1.30 % Green Federal Bond, issuance volume € 5 bn

Global Capital Bond Awards 2021: "Most Impressive Government Green/SRI Bond Issuer"

Global Capital and Environmental Finance: "Green Bond of the Year 2020"

Climate Bonds Initiative: "Largest Green Sovereign Bond 2020"

International Financing Review: "Euro Bond" & "Sustainable Bond of the Year 2020"

awarded for the 0.00% Green Federal Bond 2020 (2030), issuance volume € 6.5 bn